Ladies and Gentlemen

A word of caution before you read this post.

We the Public can only refer to data in the Public Domain. 1MDB on the other hand knows what data they have and what data was compromised by Petro Saudi. On the other side we have Claire Brown of Sarawak Report who has a set of document and will release them after she pancing 1MDB. While all of these is happening 1MDB also shares confidential information to parties who are not part of the investigation but is working for them to improve their so called "communication strategy".

And the output can be seen from how "professional" their recent responses to all queries regarding the company.

GLC bawah telunjuk BooGees beb....carpet merah..

Tapi sayang bunyi dah jadi macam AhBeng naik EVO.

Anyway let us examine the introduction of a new set of data into the Public Domain.

1MDB's Reply to Sarawak Report Allegations1MDB has been made aware of an article, dated 10 October 2015, that has been published in the Sarawak Report, an online blog currently banned in Malaysia. This article has published selectively extracted materials and contains serious and unfounded allegations, in a clear attempt to manipulate readers with respect to events that have previously taken place at 1MDB.

1. 1MDB-Petrosaudi

The fund units, owned by 1MDB subsidiary Brazen Sky Limited, were originally valued at US$2.318 billion in September 2012, as the eventual outcome of various equity and murabaha loan investments totalling US$1.83 billion by 1MDB with PetroSaudi between 2009 and 2011. Over the investment horizon, 1MDB has received and reflected in its audited financial statements, cash returns, i.e. approximately US$81 million murabaha profit, and approximately US$263 million dividends from fund unit investments, i.e. a total cash return of approximately US$346 million and a total gain over time of US$488 million (US$2.318 billion less US$1.83 billion).

2. Fund Unit Redemptions

As of 31 March 2014, the fund units were valued at US$2.33 billion. On 5 November 2014, at the time 1MDB's financial statements for the year ended 31 March 2014 were published, an amount of approximately US$1.22 billion had been redeemed, in cash, with proceeds being substantially utilised for debt interest payment, working capital and payments to Aabar as refundable deposits for options termination.

A sum of approximately US$1.11 billion in fund units remained, which together with a dividend of approximately US$130 million, equates to the remainder sum of US$1.23 billion described in the notes to 1MDB's accounts.

On 14 and 24 November 2014, approximately US$170 million of the US$1.11 billion fund units were redeemed, in cash, leaving a balance of approximately US$940 million in fund units. On 2 January 2015, i.e. prior to Arul Kanda joining 1MDB, a final redemption of approximately US$940 million was undertaken through a sale of fund units to Aabar, with cash payment being deferred. (Note: Aabar was separately a guarantor of the fund in which the units were invested but by mutual agreement, the redemption was via sale of fund units instead of calling on the guarantee. This fund unit sale agreement was subsequently superceded via the Binding Term Sheet signed between 1MDB and IPIC, the "AA" rated parent of Aabar, on 27 May 2015, upon which a payment of US$1 billion was made by IPIC to 1MDB.)

3. 1MDB President and Group Executive Director Arul Kanda's comment

Whilst Sarawak Report has published a number of alleged 1MDB related documents in the past, which we now know to be stolen and possibly doctored goods, sourced from a convicted criminal, I can confirm that – in this particular case – it appears to have published an authentic 1MDB document, namely minutes of a 12 January 2015 Board meeting. This was the first 1MDB Board meeting I attended, i.e. a week after I joined the company on 5 January 2015.

At the meeting, I stated to the Board, based on my understanding of events that occurred before my time, that the redemption of fund units happened in cash for an amount of US$940 million. However, upon further investigation and verification, it became clear that this was a misunderstanding, which I then clarified to the Board and our shareholder, the Ministry of Finance. This clarification is clearly recorded in subsequent Board minutes and can be verified.

On 13 January 2015, I confirmed via a press statement that the remaining amount of US$1.11 billion had been redeemed, in full. What was unfortunately not made clear, was that the redemptions happened partly in cash and partly through the sale of fund units, with cash payment being deferred. It is this important distinction which caused a misinterpretation of my statement, first during a Business Times interview on 9 February 2015 and subsequently by the Ministry of Finance, in a Parliamentary answer on 12 March 2015.

I have explained in detail the sequence of events to the National Audit Department and to 1MDB's auditors, Deloitte, as part of their thorough and professional review of 1MDB's past transactions. In addition, I have openly and publicly taken full responsibility in June 2015 for the misunderstanding on this matter – i.e. the buck stops with me.

In my capacity as President, I answer to the Board and the shareholder of 1MDB. My strong track record speaks for itself and my only professional agenda is to fix the challenges in 1MDB. There is no need for me to lie or cover-up what has happened in the past, as has been alleged by those who make sensationalist claims to drive their own political agenda. Accordingly, I look forward to being questioned in detail on this matter at the upcoming Public Accounts Committee hearings and for my answers to be a part of the public record, to conclusively put this matter to rest. (here)

Yes Arul

We know that you only joined 1MDB after the "redemption" was done.

And yes we also know that your track record speaks for itself....

Wonder when the MOF was informed of your "further investigation and verification"

For 127 Days the whole world was mislead to think that it was actually CASH

On 20th of May, Husnit terkebil kebil to coverline

After the 20th of May semua orang garu kepala apa benda HusNit merepek pasal Units in a Sov Wealth Backed "fund" that he is HOPING to be able to bring back.

Hoping..that's cute

If there was no pancing from SR.....noone would be aware of this new set of data that Arul has selectively disclosed hopefully without any attempt to manipulate readers with respect to events that have previously taken place at 1MDB.

On 14 and 24 November 2014, approximately US$170 million of the US$1.11 billion fund units were redeemed, in cash, leaving a balance of approximately US$940 million in fund units. On 2 January 2015, i.e. prior to Arul Kanda joining 1MDB, a final redemption of approximately US$940 million was undertaken through a sale of fund units to Aabar, with cash payment being deferred.

Note: Aabar was separately a guarantor of the fund in which the units were invested but by mutual agreement, the redemption was via sale of fund units instead of calling on the guarantee. This fund unit sale agreement was subsequently superceded via the Binding Term Sheet signed between 1MDB and IPIC, the "AA" rated parent of Aabar, on 27 May 2015, upon which a payment of US$1 billion was made by IPIC to 1MDB.

I want to dive in straight tapi gua rasa lebih baik kita refresh our memory about this chain of beliku liku "transactions"

Teman teman pasti masih ingat in my Just Units post (here) I was looking for the Summer trip picture

SR released the info sometime after my posting...

Best to start from the outset sometime mid August 2009

Not long after on August 28th an "Introduction Letter" sudah masyukkkkkk......

Teringat lagu Hail Amir

Berlari berkejaran.....tak sampai sebulan jumpa atas kapal dah intro mintak to sign JVC a month from the letter of INTROFUCKINDUCTION

Hebat.........

But that didn't happen instead an expropriation scheme was concocted in the JV Agreement to take out USD 700 Million.

Hail Amir masuk lagi....

Berlari Berkejaran........

Remember this piece of news from the Star

KUALA LUMPUR, July 11 — The hurried signing in 2009 of 1Malaysia Development Berhad’s (1MDB) now-aborted deal with PetroSaudi International (PSI) had led to two board members resigning from the Finance Ministry-owned company, investigators have revealed.

According to The Star today, former 1MDB chairman datuk Mohd Bakke Salleh and board member Tan Sri Azlan Mohd Zainol quit in protest after US$700 million (RM2.6 billion) that was meant for the 1MDB-PSI joint venture were diverted to another company without the board’s approval.

Quoting an investigator, the report said the board had directed that the money be returned to the JV company “but no action was taken”.Now we have "Selectively Extracted" materials to do a simple factcheck

Bakke resigned on October 19, 2009, while Azlan left the board earlier this year on January 11, it said.

Again quoting investigators, the English daily said board members also felt the agreement with PSI to set up the JV firm was signed too hastily.

The report said the board was informed of the deal on September 18, 2009, and 10 days later on September 28, the agreement was inked with PetroSaudi Holdings (Cayman) Ltd, a wholly-owned subsidiary of PSI.

Initial findings by investigators, however, showed that there was no document on the existence of assets and valuation of PetroSaudi Holdings (Cayman) at the time the deal was signed.

In the agreement, 1MDB was to pay the subsidiary US$1 billion (RM3.5 billion) for a 40 per cent stake in the JV. The Star report said the board agreed to the deal and for the transfer of the cash to the account of the JV.

“However on September 30, only US$300 million (RM1.05 billion) of the total US$1 billion was actually transferred to the joint venture account while US$700 million was deposited into another account,” investigators were quoted in The Star’s report as saying.

The report said the US$700 million loan was extended as a loan to the JV company by PetroSaudi Holdings (Cayman) with the condition that it was to be repaid in full on September 30.

It added, however, that board members were not made aware of this although the loan agreement was made on September 25, three days before the JV deal was signed.

“The board members were unhappy that the agreement was signed without much consideration and that US$700 million meant for the JV company was transferred to another company without their approval,” the report said. (here)

This BOD was supposed to be on

Duit sudah jalan

We need to understand apa sudah jadi

|

| Should we go ask this guy? |

Takkan la mamat ni selamba dog bole divert duit pergi GoodStar?

Now look at the BNM Data

Persoalan yang perlu di tanya kepada Puan Wan Hanisah Wan Ibrahim adalah makcik bila tahu pasal duit pi dalam account lain pastu buat bayar some "hutang" to another company never mentioned in the JV Agreement......

We now know that BOD was only aware after it all happened.

Tried to "rectify" I guess......

Wanna know how he plays...

Check out Apandi Kandasamy below

When 1MDB requested Deutsche Bank (Malaysia) Berhad to remit to a different account, Deutsche Bank (Malaysia) Berhad sought clarification from Bank Negara Malaysia and Bank Negara Malaysia responded by advising Deutsche Bank (Malaysia) Berhad that it being a business decision and as long as there was no deviation from the purpose intended and no further query was made by Bank Negara Malaysia at that particular time.

Bank Negara Malaysia being the controller did not stop the remittance or direct Deutsche Bank (Malaysia) Berhad to advise 1MDB to revert to Bank Negara Malaysia for a review of the permission. Clearly there was no information or further information requested by Bank Negara Malaysia at that material time. 1MBD rightfully furnished the information required for the purpose of the remittance. (here)NO DEVIATION FROM PURPOSE?

DANA 2.5Billion....Biar betik

Sementara Menunggu pelaburan di dalam projek2 yang akan dikenalpasti

LOL!!!!

Berlari berkejaran

Lupakan segala duka

Di kota di desa

Di gunung dan laut

Berlagu kita berdua

Dinda

Kanda ......nak aje gua letak Kandasamy tapi merosakkan lagu

Burung pun turut menyanyi

Tawa

Riang

Dan cinta mula bersemi

La la la la la la la la...

Recall my previous posting (here) where Lim Sian See tried to peddle his opinion on probable scenarios that could explain the 700Million Loan gua bagi dia Scenario D sampai hari ni senyap

Scenario D

"PS and 1MDB agree to set up JVC and together we inject CASH and we go find suitable assets that can meet the Objective of the JVC, 1MDB's iMTNs Proceeds Utilisations and 1MDB long term objective for the Nation. This way 1MDB can ensure that for EVERY DOLLAR INVESTED THE JVC CAN UTILISE IT TO GENERATE MORE RETURNS INSTEAD OF GIVING USD 700,000,000 TO MY NEW PARTNERCompare that to the BNM approval letter....

Let's go to Apandi earlier part of that statement

The alleged offence investigated into by Bank Negara Malaysia is paragraph (4)(b) of Part 1 of the Fifth Schedule to the Exchange Control Act 1953 namely, knowingly or recklessly making a statement which is false in a material particular. In short the statement made must be false and material to the subject matter i.e. the information requested by Bank Negara Malaysia at the time when the application/s for remittances were sought for and in response to further information requested by Bank Negara Malaysia. 1MDB obtained three permissions from Bank Negara Malaysia to make remittances, namely on, (1) 29 September 2009, (2) 6 September 2010, and (3) 20 May 2011. It is noted that Bank Negara Malaysia did not take more than three days to grant the said permissions on all three occasions. It is further noted that the relevant ECM forms namely 09A and 06B do not require the applicant to supply the name/s of beneficiary owner or the bank/s accounts numbers of the recipient/s or the manner as to how the funds to be channeled.The Permission was issued based on the information being submitted not Form P or R tu kerja kerani remittance department kat bank pakcik.

Heck even the BOD found out after....

|

| Apa Lagi Pendi Mau? |

Pendi guano ni weh. Jange wak malu ore klate.

BTW Pendi Kandasamy should look at the Organisation Chart of MOF to understand what exactly can BNM "do" to a company that answers directly to the PM who so happens to be the MOF as well in his free time.

Did BNM receive any "instructions" from higher ups?

Why do I ask

Simple we have another interesting datapoint where large sums of money was deposited into the PM's account, reported to BNM.........total silence up till WSJ expose.

What does that tell you Apandi?

Go figure

Anyway meleret dah pulak gua better go back to the berliku liku transaction

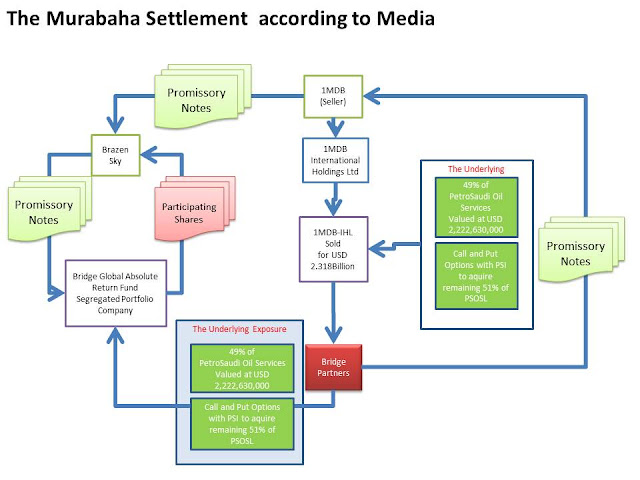

Remember the Murabahah Notes?

Bila orang tanya apa lu dapat from that Investment Arul keeps repeating what was disclosed in the Annual Report

Dude semua orang sudah tahu brader...sudah habis modal kencin ka?

But how should we value the data from the Star?

1MDB eventually sold the 49% stake to Bridge Partners International Investment Ltd in August the same year, and received promissory notes amounting to US$2.32bil (RM7.18bil) from Bridge Partners.

In the same month, 1MDB through its subsidiary Brazen Sky Ltd invested the promissory notes into Bridge Global Absolute Return Fund SPC and Bridge Partners Investment Management Company (Cayman) Ltd.(here)

This guy also after you ka ?

How bole percaya ka part of the Global Forgery Group jugak?

Anyway if that was TRUE

This is what most likely happened

Your Murabaha Notes Conversion allows you to convert to JCE Equity...which was something rather stupid to do.

Instead a company of unknown value was shoved up your ass again with an option to fully take over

Bukan kecik even larger than Sapura Kencana.

Now you go and sell this co to donno who and is willing to accept promissory notes in return...

Caya lah!!!!

He can't even pay you the Promissory Notes.

What are you guys trying to do here....

Shit by any other name is still SHIT

So that's the "Cayman Funds" folks according to the media

Wonder why Arul never argued against the Star

Recall the BOD instructions

Before the end of November 2014

Hmm....

Let me ask you something

I would assume that most Malaysian who follow this story would generally infer that the Collateral backing the Deutsche Syndicated Loan is the Cayman Funds/Brazen Sky Holdings

Anita Gabriel of Business Times Singapore wrote this sometime back

Deutsche-led group in talks over US$975m 1MDB debt

By Anita Gabriel

May 13 (Business Times) -- Singapore

THE financial plight of the debt-laden 1Malaysia Development Bhd (1MDB) is set to deepen, as jittery lenders of a US$975 million syndicated loan led by Deutsche Bank plan to ask the troubled state-owned firm to pay up before the loan falls due in less than four months.

The Business Times understands that the offshore loan, led by Deutsche Bank Singapore and syndicated to five Gulf banks including Abu Dhabi Commercial Bank, is guaranteed by the Malaysian government.

But the creditor banks have turned panicky - some more than others - as the loan is secured with 1MDB's wholly owned Brazen Sky's US$1.103 billion, which the state-backed firm has said is being kept at Swiss private bank BSI Singapore

When she wrote that Arul's only reply was that he was bound by Banking Confidentiality.

Classic

He neither confirms nor deny.

Try calibrating the timeline with the new data on redemption

One thing that does not make sense tahap gaban is the fact that this shitty company was already facing insolvency by January and yet it was willing to accept CASH PAYMENT BEING DEFERRED and proceeded to ask for standby liquidity facility to the Cabinet in February 2015

Not only that they now try to selit a very belit belit waffling statement that reminds me of someone I know on Facebook

Note: Aabar was separately a guarantor of the fund in which the units were invested but by mutual agreement, the redemption was via sale of fund units instead of calling on the guarantee. This fund unit sale agreement was subsequently superceded via the Binding Term Sheet signed between 1MDB and IPIC, the "AA" rated parent of Aabar, on 27 May 2015, upon which a payment of US$1 billion was made by IPIC to 1MDB

Holy fuckin shit!

Which Fund Units is this?

Are you talking about the Cayman Funds? If you are why the FUCK did you not disclose it in your Annual Report and why in the world is this not mentioned at all in IPICs or Aabar's account

Or is there a new Units issued by Aabar/IPIC held in BSI?

Update : Check out SR Data on the BOD Minutes talking about the "redemption"

Siap ada selit BUT by Mutual Agreement

Nak kena tanya bilamasa pulak tu was it when you first invested into the Cayman Fund ke or was it after Petro Saudi bail out lu menggelabah cari pak Arab lain?

Or was it after lu dah bayar duit 1MDB pada Aabar?

We now need to bring Aabar now into the Picture...

Mamat ni giler terer...Tahap Gaban siot

Bab bab guarantee ni kita harus hantar semua institutions kita yg offer guarantee business pi blajar kat Aabar

According to the Edge (which was never denied specifically by 1MDB...or I may have missed it)

Covering The Hole:

1. In 2012, the International Petroleum Investment Corp (IPIC) of Abu Dhabi was given an option to subscribe to 49% of the future listing of the power assets owned by 1MDB. This 10-year option, which was later transferred to IPIC’s associate Aabar Investments, was for co-guaranteeing two bonds totalling US$3.5 billion that 1MDB issued.

2. In May, 2014, 1MDB and Aabar signed an agreement to terminate the options. This was stated in Page 172 of 1MDB’s FY2014 accounts but no details were given.

3. In page 169 of the FY2014 accounts, it was stated that 1MDB had obtained a bridging loan of US$250 million to buy back the options.

4. In page 171, it was stated that on Sept 2, 2014, Aabar had written to 1MDB that it wished to terminate the options according to the terms set out in the agreement signed in May. Again, no details were given.

5. 1MDB has never given out enough details of the terms and costs of terminating the Aabar options. But 1MDB appeared to have paid Aabar the following as termination costs:

i) US$250 million paid in May, 2014

ii) US$975 million paid in September, 2014 via a Deutsche Bank loan

iii) US$993 million paid in November, 2014 via a partial redemption of the Cayman SPC funds.

6. This adds up to a total of US$2.22 billion.

7. The scheme to cover the US$2.32 billion hole at the Cayman SPC is by paying Aabar US$2.22 billion as option termination fee. Aabar then passes the money to the Cayman SPC from which 1MDB would then be able to redeem the money, thus covering the money that was already gone.

8. The termination fee totalling US$2.22 billion that 1MDB paid to Aabar between May and November, 2014 was, however, not reflected in the FY December, 2014 of IPIC (which owns 100% of Aabar) as income or revenue. There were no such entries in IPIC’s accounts. This reinforces our analysis that the termination fees paid to Aabar were in reality used to cover the hole at the Cayman SPC.

If those number were true

Imagine this

IPIC was the guarantor for a USD 3.5 Billion Issuance

It gets to keep USD 1 Billion as part of Collateral

It also get the Option for providing the Guarantee

It then terminates the Option

1MDB pays IPIC USD 2.22Billion

IPIC still holds USD 1 Billion of 1MDB's money

Total USD 3.22 Billion

Net exposure to 1MDB is only 300Million Tops....sweet fuckin deal

Ever wondered why IPIC/Aabar terminated the Options?

TO FACILITATE THE LISTING OF THE GROUP ENERGY ASSET

What that means is that the Securities Commission WILL never approve the IPO if the Option was there...

|

| Lu Gila ka mau saya approve IPO ada Pak Arab pegang option bole beli 49% |

But instead 1MDB tembak sekampung about the derailment of the Energy IPO due to Political Actors

Lame.....

BTW I don't think The Edge numbers adds up

The Official Data only indicate

And even then any amount paid is refundable

Even a reliable estimate cannot be determined by the Auditors

This is confirmed by Pahlawan 117

I guess we all have to wait for the appropriate announcement

While we wait for that we must also ask why the Securities Commission has been super duper quiet about this whole fiasco

Why do I ask that?

As a Securities Regulator one must ensure that funds raised in your jurisdiction should comply with the Offering Documents

Berapo banyok ore Ganu boleh duit?

DinTurtle sapu semua ka? Nate sungguh

Look at the main conditions every single cent MUST BE IN COMPLIANCE WITH SHARIAH PRINCIPLES

Is the Payment to GoodStar in Compliance?

Or what about the Options Embedded Murabaha with FX Cover?

Or the Promissory Notes issued by Bridge Partners

Tara bunyi langsung ka itu bai?

We now go to the last of part of this post

The numbers that 1MDB lempar kat kita.....

Always rounded up high level data instead of exact numbers...scroll up are read the incoherent giler belit statement

I've tried my best and the numbers don't add up

Sapa sapa yg rasa ada waktu nak SEKOLAH kan gua silakan....promise you I'll be a good student

The table is constructed based on 1MDB Financial statements. The Counter party Exposure Column shows how much money is at RISK.

There is still USD 185,000,000 unaccounted for based on my readings. Feel free to show that everything is FULLY REDEEMED just like your misleading Press Statement on the 15th of January.

Add on Readings for better context on this posting

1. Just Units: Pre-PAC Questions for Arul Kanda (here)

2. Just Asking: Conversations with Unverified Unofficial Spokes Person for 1MDB (here)