As expected Lim Sian See has responded but in draft mode

He provided a preview to the post after I posted link here (note link token expired)

UPDATE 1539HRS LSS has published the post here

As I mentioned in my previous post

Let us start with his explanation on the 700Million USD Loan provided by PSI to JV Co

Let us go back into February, when I first send that tweet out, I drop by one of your post asking a rather similar question

So between Feb 24 to July 3 LLS is can only provide SCENARIO A and B

NOT VERIFIABLE DATA

What if I provide another SCENARIO........lets call it SCENARIO C

Too far fetched LSS?

I don't think so cause that was what inside the "Introduction" letter allow me to reproduce it again incase you've missed it

Or how bout SCENARIO D

PS and 1MDB agree to set up JVC and together we inject CASH and we go find suitable assets that can meet the Objective of the JVC, 1MDB's iMTNs Proceeds Utilisations and 1MDB long term objective for the Nation. This way 1MDB can ensure that for EVERY DOLLAR INVESTED THE JVC CAN UTILISE IT TO GENERATE MORE RETURNS INSTEAD OF GIVING USD 700,000,000 TO MY NEW PARTNER

I can go on and on with a number of other possible scenarios but let's leave the scenarios to cerpen writers

What we need is DATA

More importantly VERIFIABLE Data

Big question now is how did it came about....the 700,000,000 Loan that needs to be repaid almost immediately...if introduction says something else

Even if we look at LSS SCENARIO A that he has claimed to be "what actually happen".. JVC value is still 2.5B with the loan being there, so why the rush.....why can't it wait say 2 years to be paid back to PS? (Do help me out here LSS sebab gua termasuk golongan UNINITIATED bab ni)

Again why the rush....aku masih kurang ngerti mas

LSS the suspicion is NOT ABOUT THE ACCOUNTING ENTRIES...

Go back to our original conversation in February.....I don't think we have move an inch mate.

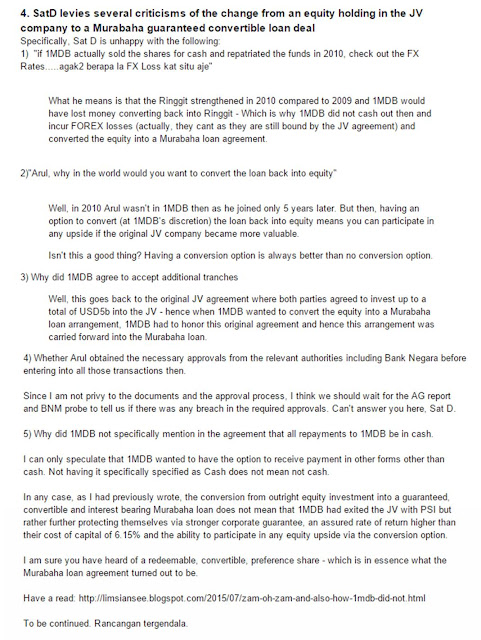

LSS then goes on further

LSS seems to think that the Original JV Agreement is STILL IN FORCE after 1MDB sold its shares via the ShareSale Agreement, he actually wrote a post about it

Key words here is

1MDB shall sell the Shares and JVC will purchase ON COMPLETION DATE, before Completion date 1MDB is still entitled to all manufactured income from the Equity Security it held in JVC

So when is the Completion date then

So I really wonder how 1MDB is still be a part of the Original JV Agreement when they are NO LONGER SHAREHOLDERS to JVC

Heck even Arul said this

If we were to look at it from a sequencial perspective 1MDB is now Murabaha Notes Holder Vs the Company, in other words they are CREDITORS with an Option to Covert back to the same Equity that they Sold before.

The logic being used by 1MDB and LSS is that

Let's look at the Conversion again

In simple terms basically you can convert Annual Coupon or Principal Repayment into Equity of JVC

Lets assume you convert your 1st Annual Coupon to Equity what happens then?

Theoretically you are now a Shareholder equivalent to your (1st Annual Coupon/B)XC

I would say congratulations! As Shareholder of JVC, 1MDB now partially owns a Company that still owes 1MDB, where is the EQUITY UPSIDE?

We can do this for the whole set of Coupons...the more you convert the Less the Murabaha Loan Outstanding Principles becomes, hence providing you lower cashflow value from coupon income perspective

What is the Conversion Price? Wouldn't upside involves the possibility of the JVC Equity Price being Greater than the Conversion Price?

LSS seems to also think that this the Murabaha Facility is equivalent to a Redeemable Convertible Preference Share

Actually it is something that I'm not quite sure of......even 1MDB was not quite sure of what it really is

Look at the notes in their 2012 Accounts

Clarification after 1 year tu beb.....tak berapa paham terms and conditions ke?

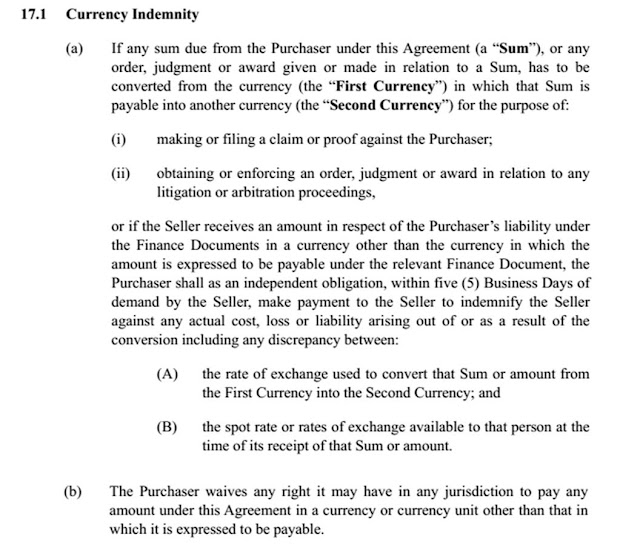

NO FX Risk at all.....ye ke

Pretty Cool..... tapi sy masih belum paham sepenuhnya

As an UNINITIATED PERSON I shall try to do a Financial Engineering Specification on the Murabaha Facility have a look below and tell what "Instrument" this thing is

Is this instrument Shariah Compliant? What contract did JVC used to protect the FX Risk on behalf of 1MDB?

Anyway folks LSS also tried to answer with regards to some of my queries on Petro Saudi entity level information

Thank you for your opinion

Actually the correct answer would be

Hi SatD my FB fren for 1 year , here you go PetroSaudi's Annual Report for the Past 5 years so that we can all validate how they have been moving their assets over the years. Especially the Part when JVC suddenly is holding PSOil as part of its portfolio, how did this happen... when prior to this our JVC only had 2 assets. And as a special bonus for our good friendship here a copy of JVC 1MDB PS Annual Financial Statements since 2009 to 2013

But then again your're NOT 1MDB and neither are you on 1MDB payroll as you keep on repeating on a daily basis.....

FACT IS You are just an anonymous Facebooker who recently opened a Blog.

Take care my dear LSS......

|

| Source (here) |

UPDATE 1539HRS LSS has published the post here

As I mentioned in my previous post

Do let me know if I've missed anything or if you have supporting documents that could add more granularity to the transactions mentioned above.Since LSS has responded in "draft mode" I'm unable to copy paste the contents of his post over, only way is to for screen print so bear with me folks

Let us start with his explanation on the 700Million USD Loan provided by PSI to JV Co

Let us go back into February, when I first send that tweet out, I drop by one of your post asking a rather similar question

|

| Source here |

NOT VERIFIABLE DATA

What if I provide another SCENARIO........lets call it SCENARIO C

- PS inject Assets valued at USD 2,000,000,000

- PS provides USD 500,000 Valuation Discount

- PS asset injection is USD 1,500,000

- 1MDB injects USD 1,000,000

- NO NEED VALUE EXTRACTION OF USD 700,000,000 and STILL MAINTAIN 60:40 ratio

Too far fetched LSS?

I don't think so cause that was what inside the "Introduction" letter allow me to reproduce it again incase you've missed it

Or how bout SCENARIO D

PS and 1MDB agree to set up JVC and together we inject CASH and we go find suitable assets that can meet the Objective of the JVC, 1MDB's iMTNs Proceeds Utilisations and 1MDB long term objective for the Nation. This way 1MDB can ensure that for EVERY DOLLAR INVESTED THE JVC CAN UTILISE IT TO GENERATE MORE RETURNS INSTEAD OF GIVING USD 700,000,000 TO MY NEW PARTNER

I can go on and on with a number of other possible scenarios but let's leave the scenarios to cerpen writers

What we need is DATA

More importantly VERIFIABLE Data

Big question now is how did it came about....the 700,000,000 Loan that needs to be repaid almost immediately...if introduction says something else

Even if we look at LSS SCENARIO A that he has claimed to be "what actually happen".. JVC value is still 2.5B with the loan being there, so why the rush.....why can't it wait say 2 years to be paid back to PS? (Do help me out here LSS sebab gua termasuk golongan UNINITIATED bab ni)

Again why the rush....aku masih kurang ngerti mas

LSS the suspicion is NOT ABOUT THE ACCOUNTING ENTRIES...

Go back to our original conversation in February.....I don't think we have move an inch mate.

LSS then goes on further

LSS seems to think that the Original JV Agreement is STILL IN FORCE after 1MDB sold its shares via the ShareSale Agreement, he actually wrote a post about it

Secondly, 1MDB NEVER exited the JV with PSI after 6 months.

Yes, repeat. NEVER exited the JV completely with PSI after 6 months.

On the contrary, 1MDB further protected itself and improved its position with regards to this partnership.

What 1MDB did was that to ask PSI to protect 1MDB by converting the equity investment into a secured Murabaha loan with a guaranteed per year return and the ability to enjoy any upside via a conversion option in this arrangement. (here)Let us now go into the ShareSale Agreement

Key words here is

1MDB shall sell the Shares and JVC will purchase ON COMPLETION DATE, before Completion date 1MDB is still entitled to all manufactured income from the Equity Security it held in JVC

So when is the Completion date then

So I really wonder how 1MDB is still be a part of the Original JV Agreement when they are NO LONGER SHAREHOLDERS to JVC

Heck even Arul said this

Further to an earlier joint venture arrangement in 2009, 1MDB invested USD1.83 billion cash in murabaha notes issued by JV Co, a company that, by then, was 100% owned by PetroSaudi following the termination of the joint venture in March 2010.

If we were to look at it from a sequencial perspective 1MDB is now Murabaha Notes Holder Vs the Company, in other words they are CREDITORS with an Option to Covert back to the same Equity that they Sold before.

The logic being used by 1MDB and LSS is that

This arrangement essentially allows 1MDB to have better protection for their investment, a guaranteed return on investment higher than their cost of capital (10.4% vs 6.15%) and to still benefiting from any upside by converting back into ordinary shares at a pre-agreed rate. -LSS (here)and

It is also important to highlight that a) the murabaha notes were guaranteed by PetroSaudi (thereby having a lower risk profile than equity) and b) 1MDB had an option to convert the murabaha notes into equity. Accordingly, 1MDB exercised caution by reducing its risk profile from equity to debt, thereby benefiting from a fixed rate of return above its cost of capital whilst having the right to participate in future equity upside through the conversion option. -1MDB

Let's look at the Conversion again

In simple terms basically you can convert Annual Coupon or Principal Repayment into Equity of JVC

Lets assume you convert your 1st Annual Coupon to Equity what happens then?

Theoretically you are now a Shareholder equivalent to your (1st Annual Coupon/B)XC

I would say congratulations! As Shareholder of JVC, 1MDB now partially owns a Company that still owes 1MDB, where is the EQUITY UPSIDE?

We can do this for the whole set of Coupons...the more you convert the Less the Murabaha Loan Outstanding Principles becomes, hence providing you lower cashflow value from coupon income perspective

What is the Conversion Price? Wouldn't upside involves the possibility of the JVC Equity Price being Greater than the Conversion Price?

LSS seems to also think that this the Murabaha Facility is equivalent to a Redeemable Convertible Preference Share

Actually it is something that I'm not quite sure of......even 1MDB was not quite sure of what it really is

Look at the notes in their 2012 Accounts

Clarification after 1 year tu beb.....tak berapa paham terms and conditions ke?

NO FX Risk at all.....ye ke

Pretty Cool..... tapi sy masih belum paham sepenuhnya

As an UNINITIATED PERSON I shall try to do a Financial Engineering Specification on the Murabaha Facility have a look below and tell what "Instrument" this thing is

Is this instrument Shariah Compliant? What contract did JVC used to protect the FX Risk on behalf of 1MDB?

Anyway folks LSS also tried to answer with regards to some of my queries on Petro Saudi entity level information

Thank you for your opinion

Actually the correct answer would be

Hi SatD my FB fren for 1 year , here you go PetroSaudi's Annual Report for the Past 5 years so that we can all validate how they have been moving their assets over the years. Especially the Part when JVC suddenly is holding PSOil as part of its portfolio, how did this happen... when prior to this our JVC only had 2 assets. And as a special bonus for our good friendship here a copy of JVC 1MDB PS Annual Financial Statements since 2009 to 2013

But then again your're NOT 1MDB and neither are you on 1MDB payroll as you keep on repeating on a daily basis.....

FACT IS You are just an anonymous Facebooker who recently opened a Blog.

Take care my dear LSS......